Affordable Housing 101

Are you a developer, builder, landlord, or homeowner interested in creating affordable housing in Bruce County? This website provides information on the context for affordable housing creation in Bruce County and its local municipalities, with step-by-step guides, tools, and other resources to support your projects.

It will include two toolkits, tailored to developers of multi-residential buildings, developers and builders of low to medium density housing, and homeowners or landlords who could intensify their properties. The toolkits build on the Affordable Housing 101 Guide, which provides foundational information to help you get started.

Together, we can create the housing we need to sustain a healthy and prosperous future for Bruce County.

| Attachment | Size |

|---|---|

|

|

1.15 MB |

|

|

4.63 MB |

What is affordable housing?

Affordable housing is the foundation for a strong, resilient community, sustainable economy, and place where people can thrive. Bruce County is working to create opportunities to increase supply and reduce costs for households that may have difficulty obtaining housing they can afford.

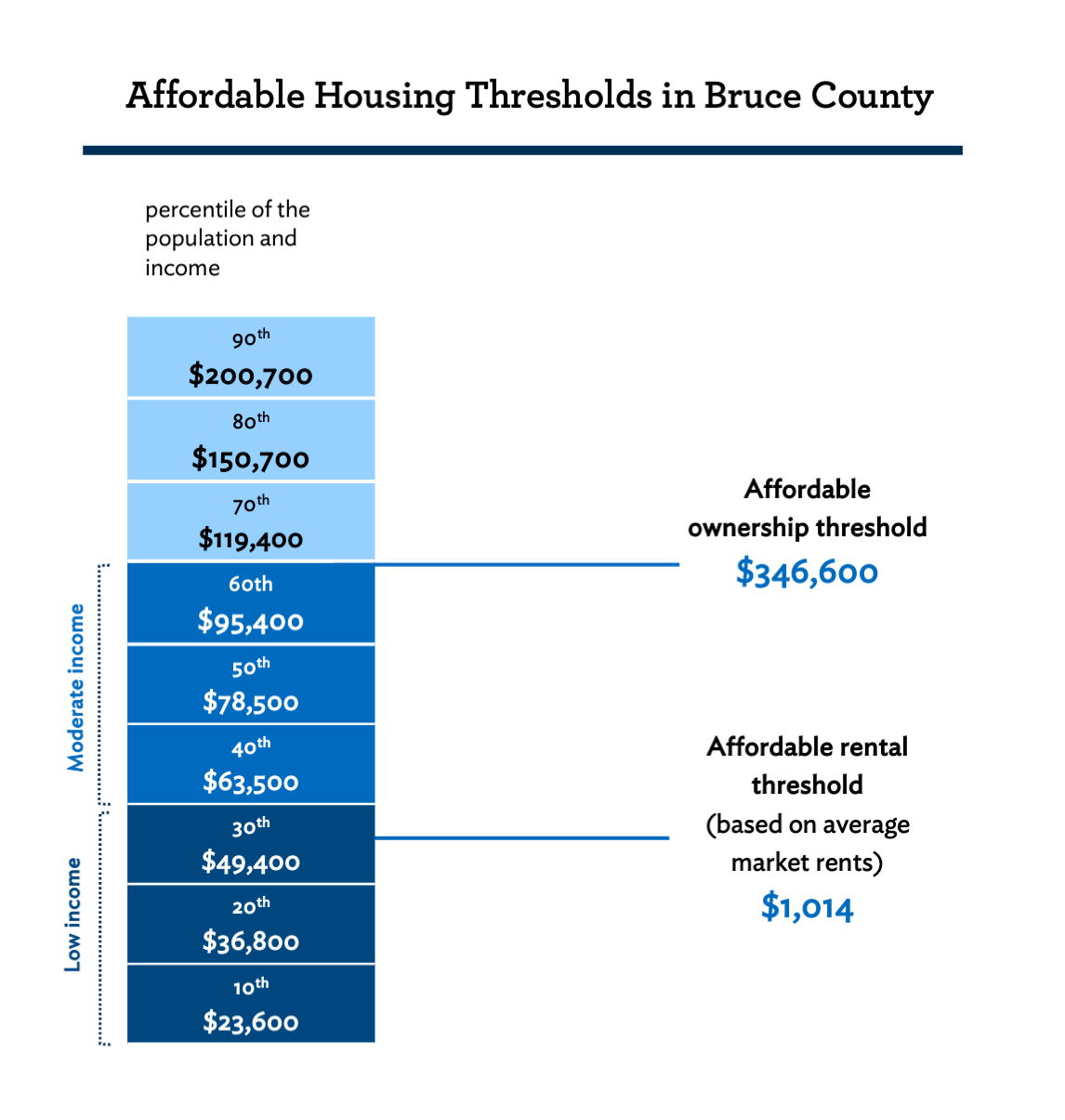

It is broadly accepted that housing is affordable when a household is not spending more than 30% of its income on housing costs. The province has also defined affordable housing thresholds for households of low and moderate income. For ownership housing, the affordable housing threshold is housing that is affordable to households with incomes at the 60th percentile. For renter households, the affordable housing threshold is 100% of average market rent as published by Canada Mortgage Housing Corporation (CMHC).

In Bruce County, the affordable housing thresholds for 2020 are rents below $1,014 and ownership costs below $346,600.

Why build affordable housing in Bruce County?

It is projected that over the next 25 years, Bruce County will have an older than average population, marked by an influx of younger retirees and population growth in younger age brackets. Building affordable housing of various types and forms in Bruce County will create housing options that reflect the life stages of individuals and families, contributing to the development of complete and inclusive communities. Housing is a major contributor to economic growth, social stability, and household wealth, while supporting community wellbeing and prosperity.

Affordable housing improves the quality of life of residents in Bruce County.

- Affordable housing options that reflect the life stage of households can accommodate a diverse mix of residents, including young families, new professionals, and seniors

- Households are better able to sustain their households and maintain their residency when it’s affordable

- Residents can better contribute to their community, improve their education, and gain access to services when they have safe and stable housing

Affordable housing can help Bruce County achieve economic development goals.

- Affordable housing supports health and wellbeing, providing a foundation for people to find and maintain employment

- Households can purchase better quality food and goods, and increase leisure spending, boosting local economic activity

- Affordable housing can lead to the retention of skilled workers in local sectors

- Businesses can draw from an adequate pool of talent, creating confidence for companies to expand locally

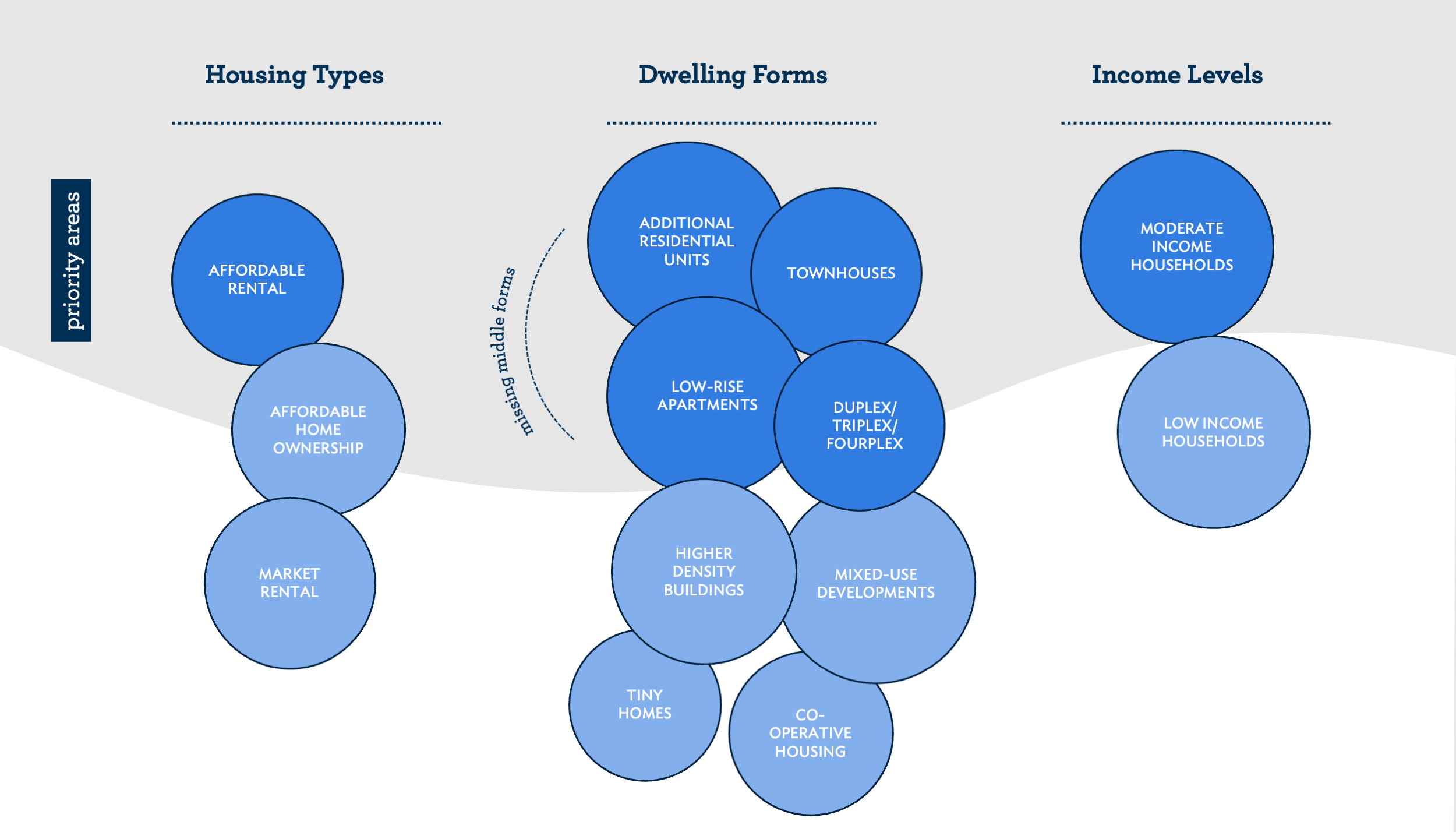

The housing landscape includes a range of housing types and forms, serving households at different income levels. While the County needs housing of all types and forms at a range of price points, priority areas have been identified where developers, builders, landlords, and homeowners could play a role in contributing to the housing supply.

Housing Types and Income Levels

As of the 2016 Census, 45% of renters in Bruce County report spending more than 30% of their income on housing, which is above what is considered affordable.

Our communities need developers, builders, and homeowners to create new rental housing that is affordable to moderate income renter households earning $31,500 to $47,000 a year , with monthly rents ranging from $790 to $1,190.

There is also an opportunity for developers and builders to create new ownership housing that is affordable to moderate income households earning $63,500 to $95,400 annually, with purchase prices in the range of $230,700 to $346,600.

Dwelling Forms

Bruce County needs more diverse forms of housing, particularly one- and two-bedroom units. These homes could take the form of additional residential units on an existing property, townhouses, low-rise apartments, or other missing middle typologies. From public consultations, we learned there may be interest in other forms of residential developments, such as mixed-use buildings, tiny home communities, co-operative housing, and higher density apartments.

Increasing the affordable housing stock, as well as the diversity of dwelling forms is imperative to Bruce County’s vision for the future and requires all hands on deck.

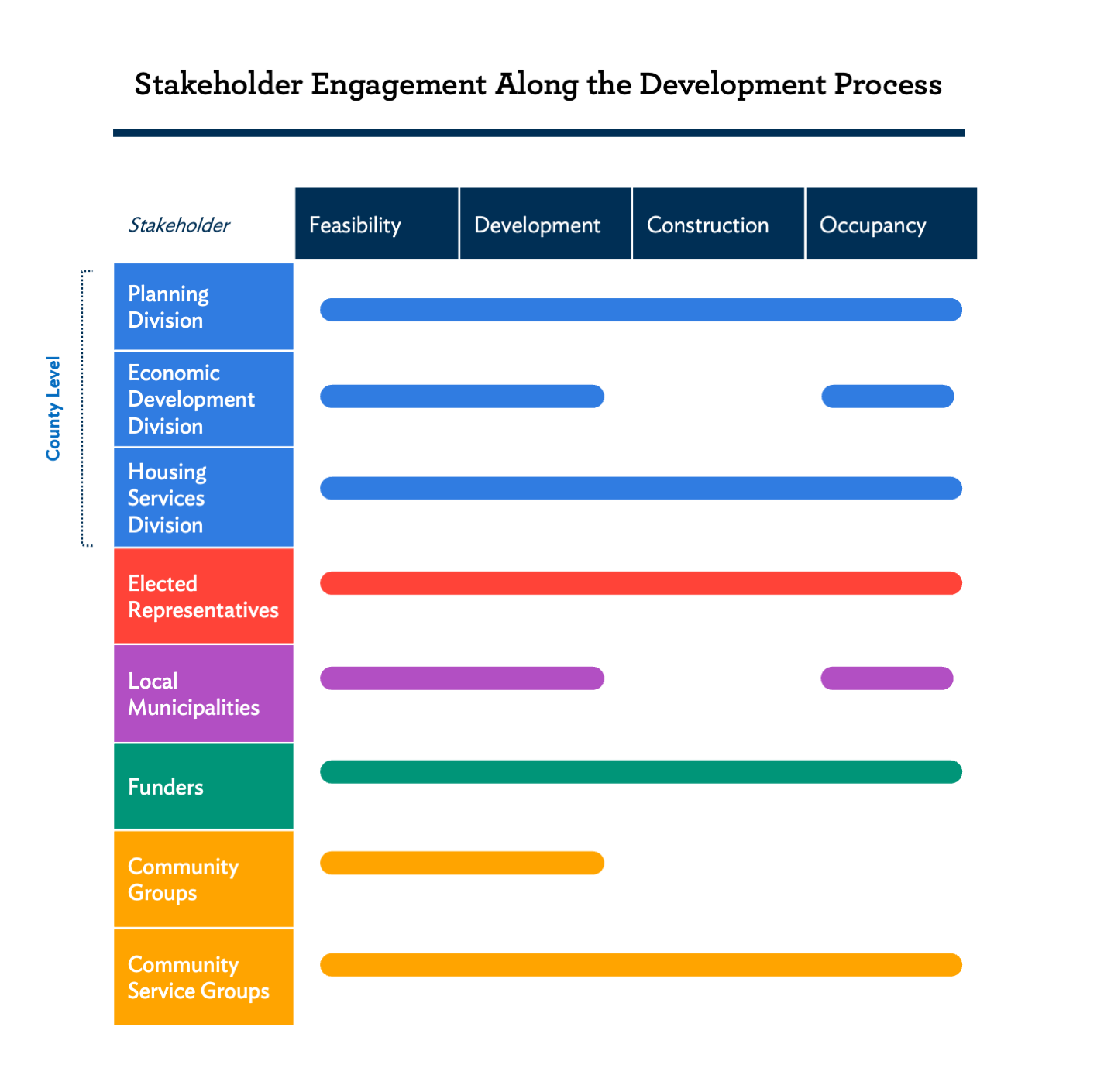

Planning Division

- The Planning team can help guide you to the best place for your development and provide support through the planning approval process with local municipalities if changes are needed to accommodate your proposal.

Economic Development Division

- Economic Development Officers provide strategic advice on pre-submission applications to local municipalities, specifically on multi-residential and commercial development projects.

- The Division is eager to support projects that facilitate the creation of affordable stable housing to support workforce development, growth of local businesses, and opportunities for entrepreneurship and innovation.

Housing Services Division

- As the Service Manager, Bruce County establishes, administers, and funds housing and homeless programs and services. The Housing Services Division manages the administration and directly provides housing supports and services.

- The Housing Services Division supports the delivery of housing programs and services.

- The System Services Manager supports the development of affordable housing.

Elected Representatives

- Bruce County Council is comprised of the eight mayors from each local municipality, of which the Warden is the peer-elected head. Each local municipality also has its own council of elected officials.

- Engaging Elected Officials early in the decision-making process can generate support for the final decisions reached by municipal or County-level decision-makers.

Local Municipalities

- Residents and builders can contact local municipalities to learn the zoning of properties and permitted uses, as well as start their planning applications and building permit applications.

Funders

- Review the available funding programs and coordinate with the Housing Services Division of the Human Services Department to explore funding opportunities for your affordable housing project.

Community Services and Groups

- Engaging local institutions, community groups, and residents throughout the development process can help to build support and foster a sense of community ownership for the project.

- Good public engagement also makes project implementation more efficient with less need to revise plans.

Overview of the Bruce County Context

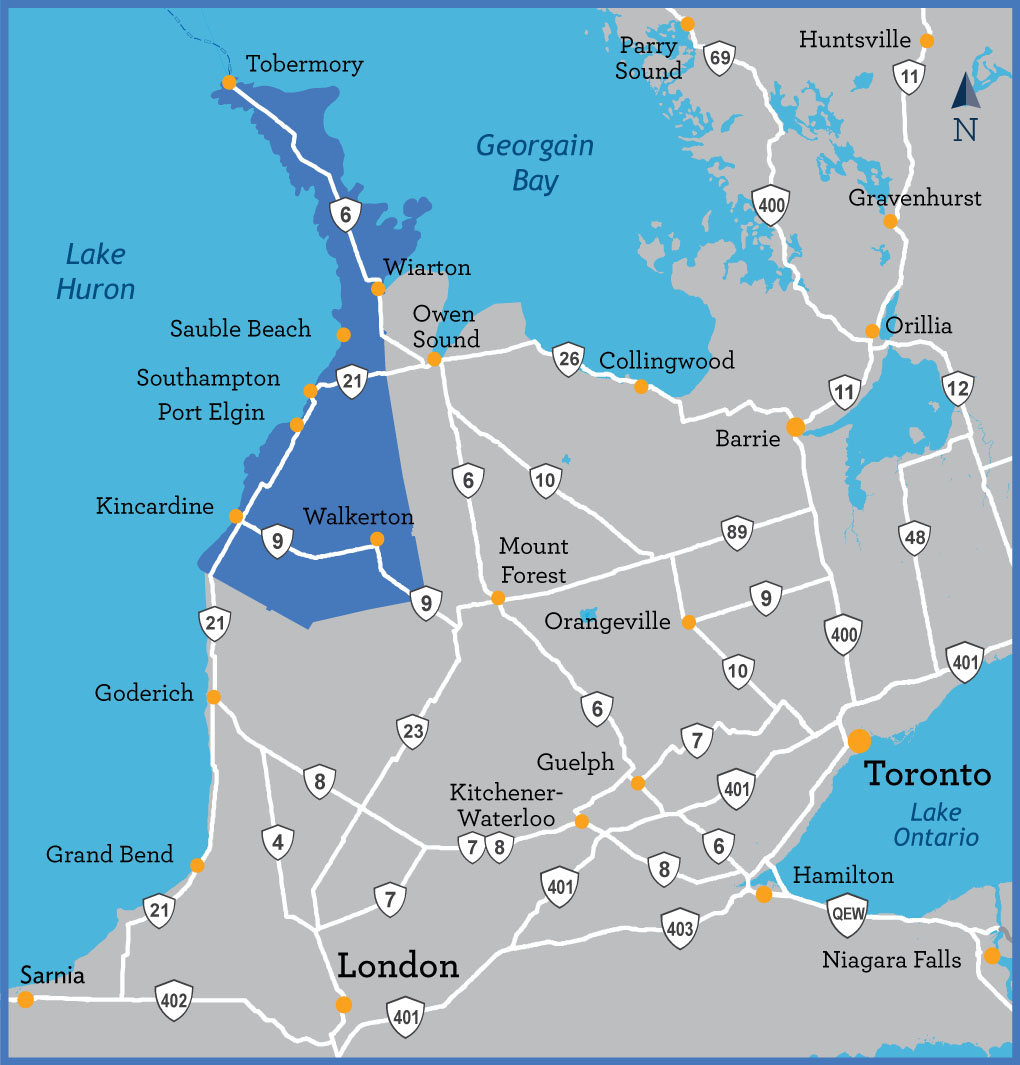

Bruce County is located in Southwestern Ontario, along the shores of Lake Huron and Georgian Bay. Encompassing rich farmland and unspoiled nature, the County consists of eight municipalities and two First Nations that are diverse in character, but all offer residents a high quality of life and an enviable lifestyle.

In 2016, the population of Bruce County was 68,147 and this is expected to grow by 14.5% to 86,000 by 2046. 60% of the population are in the working age group between 15 to 64 years old, with a labour force participation rate of 60.1%. By 2046 there are expected to be roughly 40,600 jobs in the County, an increase of 14.3% from 2021. The County’s unemployment rate of 3.0% is below the provincial rate of 7.0%. The median household income in 2016 was $71,193.

Housing Needs and Issues

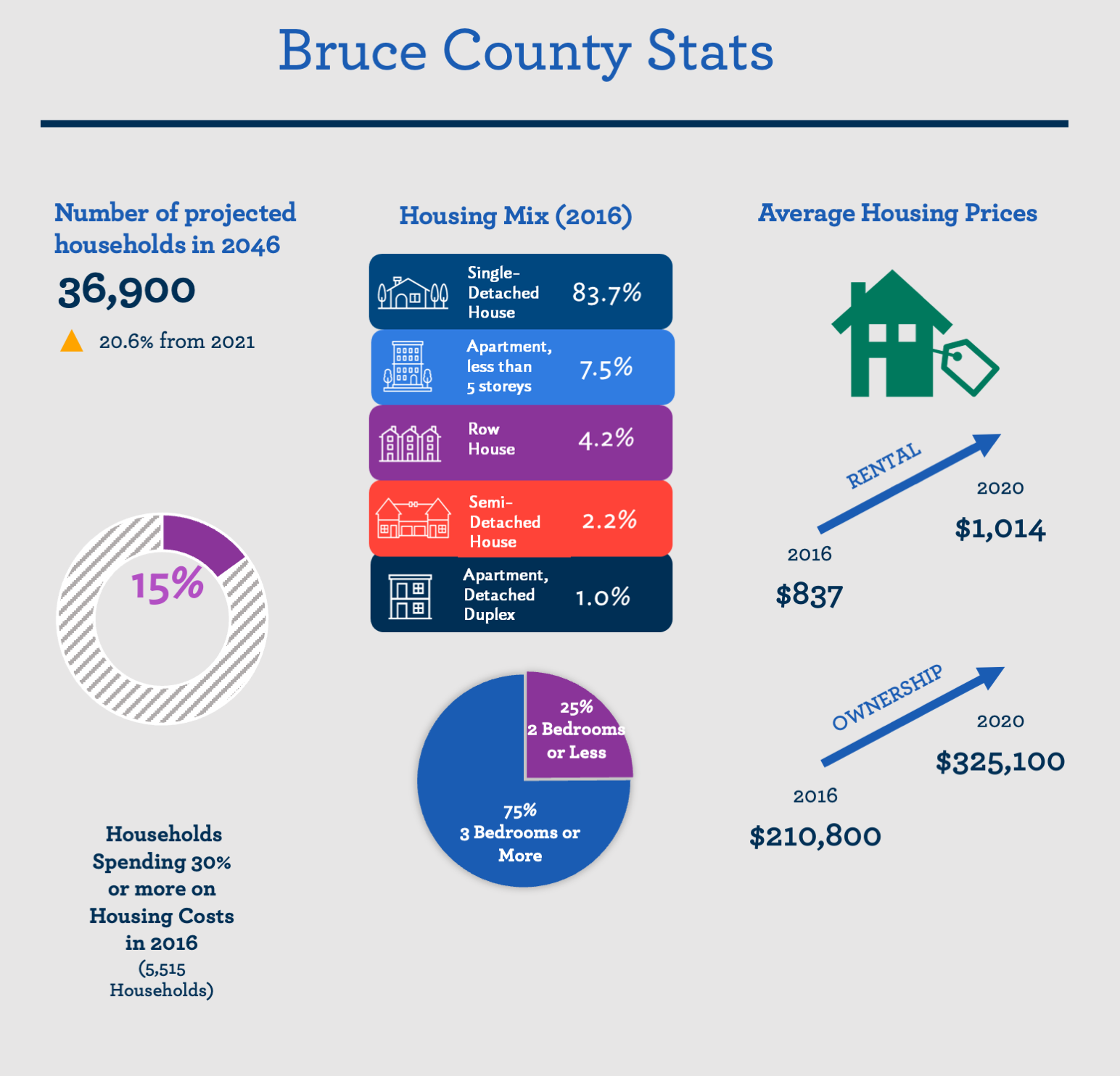

- There were a projected 30,600 households in Bruce County in 2021, which is up by 7.7% from 2016. By 2046, the County is projected to grow to 36,900 households.

- In 2016, nearly 15% of homeowners in Bruce County were spending over 30% of their income on their housing. For renter households, the proportion spending over 30% of their income on housing was over 45%.

- From 2016 to 2020, average rental prices in Bruce County grew from $837 to $1,014, marking a 17.5% increase in the cost of rental housing. Similarly, the cost of ownership increased during the same period by 35.2% as the cost of a home grew from $210,800 in 2016 to $325,100 in 2020.

- In recent years, housing unaffordability in Bruce County has been driven by three factors: a general shortage of new housing construction, a lack of diversity in built forms, and an increase in demand for housing as more people are coming to settle in Bruce County, driven by economic opportunities and effects of the COVID-19 pandemic.

- In 2016, single detached homes represented 83.7% of housing types in Bruce County, with apartments that have 5 storeys or less as the second most common type of dwelling (7.5%), followed by row houses (4.2%). This trend has continued in the major population centres of Bruce County as 52.4% of all new housing developments in Saugeen Shores were single detached homes in 2020. Similarly in Kincardine, 64.5% of all new builds were single detached homes.

- There is a particular need for one- and two-bedroom units in Bruce County. In 2016, only 24.9% of all homes in Bruce County had two bedrooms or less. This issue can begin to limit employment growth in Bruce County as low- and moderate-income workers migrating to the County will have greater difficulty finding places to live.

- In 2021, there were approximately 634 applicants on the waitlist for Community Housing which is a 29.3% increase from 2018. Most applicants (95.0%) in 2021 requested rent-geared-to-income housing. This demonstrates the significant need for subsidized housing options and the affordability challenges faced by lower income households throughout the County.

Housing Strategies

Bruce County released its Long Term Housing Strategy, Housing Choices for All, in 2013. In 2019, a Housing and Homelessness Plan update modernized key strategies to help meet the housing needs of communities. The update included actions to increase the stock of affordable housing in the County to meet the target of creating 445 new affordable housing units between 2013 and 2023.

What you should know about developing here

Given the shortage of “missing middle” housing units in Bruce County, there is an untapped opportunity for property owners and private developers to satisfy that demand. Building new housing units in Bruce County can benefit the economy, the community, and provide a healthy bottom line.

Bruce County has a two-tier system with a County government and local municipal governments. The County’s Planning Staff assist local municipalities with preparing plans and by-laws, and processing applications for land use changes and lot creation. Local municipalities lead the process for zoning interpretations, site plan approvals, and building permits.

Bruce County prides itself on being easy to work with for development approvals. County Planning and Housing Staff are eager to help property owners and developers build housing that meets community needs.

Development Tools and Incentives

Bruce County is committed to helping property owners build more affordable housing, especially those units which meet demand for the “missing middle” housing stock. Towards this end, the County is in the process of investigating new tools, including consideration of a new development charges waiver program, which would be targeted towards the construction of new affordable housing.

Overview of the Municipal Context

Arran-Elderslie encompasses Chesley, Paisley, Tara, and the former townships of Arran and Elderslie. Many people enjoy living in Arran-Elderslie due to its proximity to major employers, as well as the rural lifestyle, small town safety, and welcoming communities. Major industries within Arran-Elderslie include agriculture, retail, tourism, and construction.

In 2016, Arran-Elderslie had a population of 6,803. The population is expected to grow by 11.6% in 2046 to 7,900 people. In 2016, 60% of the population was aged 15-64, with a labour force participation rate of nearly 62%.

The number of jobs in Arran-Elderslie is expected increase 20% to 2,500 by 2046, which includes those working from home or with no fixed place of work. As of 2016, the median household income, before taxes, was $63,687.

Housing Needs and Issues

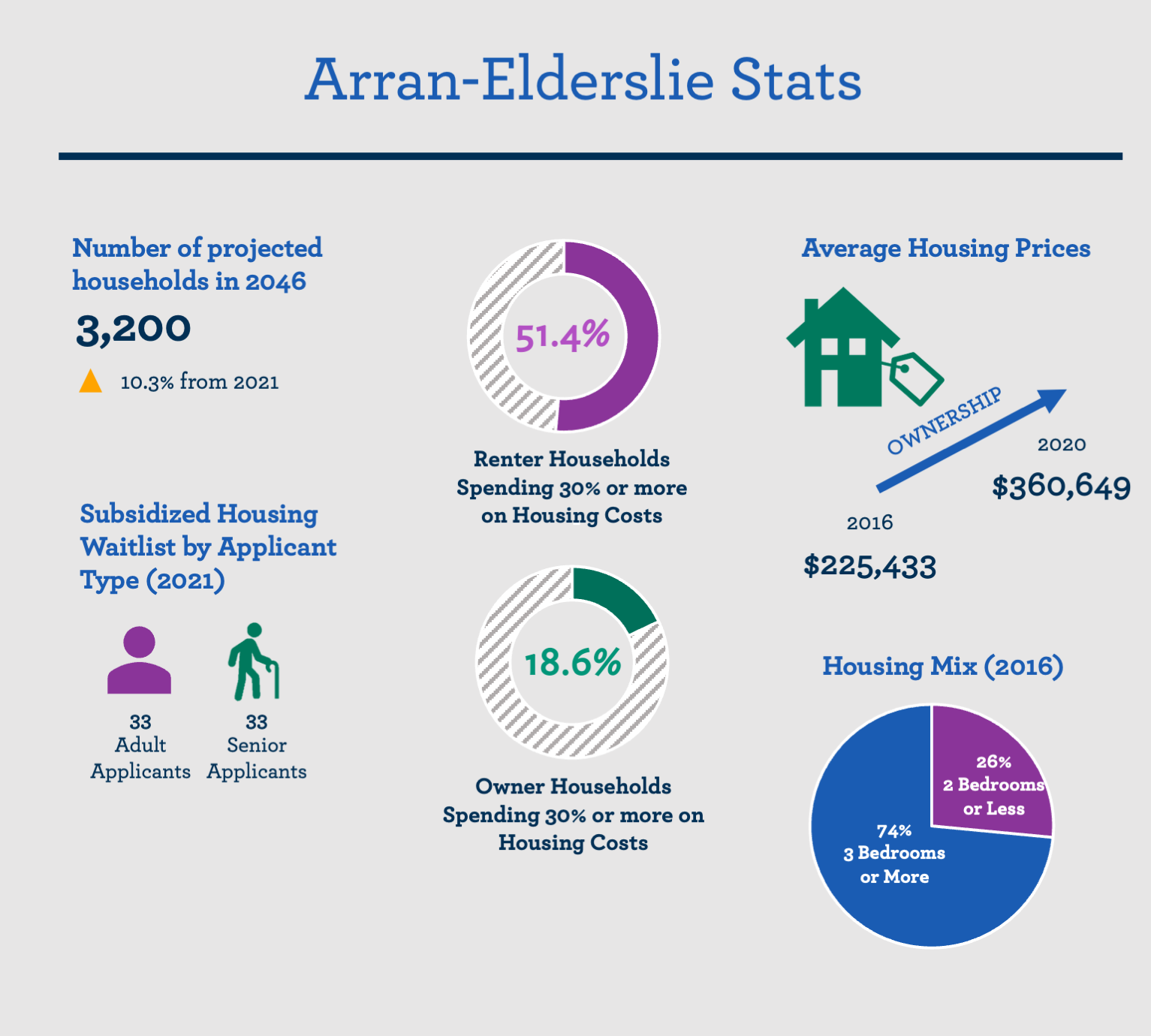

- There were a projected 2,900 households in Arran-Elderslie in 2021 and by 2046, there are expected to be an additional 300 households in the municipality.

- In 2016, 18% of homeowners in Arran-Elderslie were spending over 30% of their income on their housing, which is significantly higher than Bruce County overall. For renter households, over 51% were spending over 30% of their income on housing.

- Housing unaffordability is a trend that will continue, as the cost of owning a home in Arran-Elderslie has grown $225,433 in 2016 to $360,649 in 2020, representing a 37.5% increase in the cost of purchasing a home.

- In 2021, there were 66 households on the waitlist for subsidized housing in Arran-Elderslie. The applicants were evenly split between seniors and adults. The number of seniors on the waitlist fell from 42 in 2019 to 33 applicants in 2021. The number of adults fell from 58 to 33 applicants.

- The working age group between 15 and 64 years old makes up 60% of the population, while seniors make up 19.2%. In 2016, only 26.5% of all dwellings in Arran-Elderslie had 2 bedrooms or less. This indicates a need for more affordable, smaller sized housing options suited to working age individuals and older adults looking to downsize

What you should know about developing here

Arran-Elderslie has a local building department, which is responsible for zoning administration and site plan approvals and building permits. Minor variances, zoning changes, and plan amendments, as well as lot creation proposals, are processed by the Bruce County Planning Department.

Development Tools and Incentives

Arran-Elderslie does not levy development charges on new development.

Overview of the Municipal Context

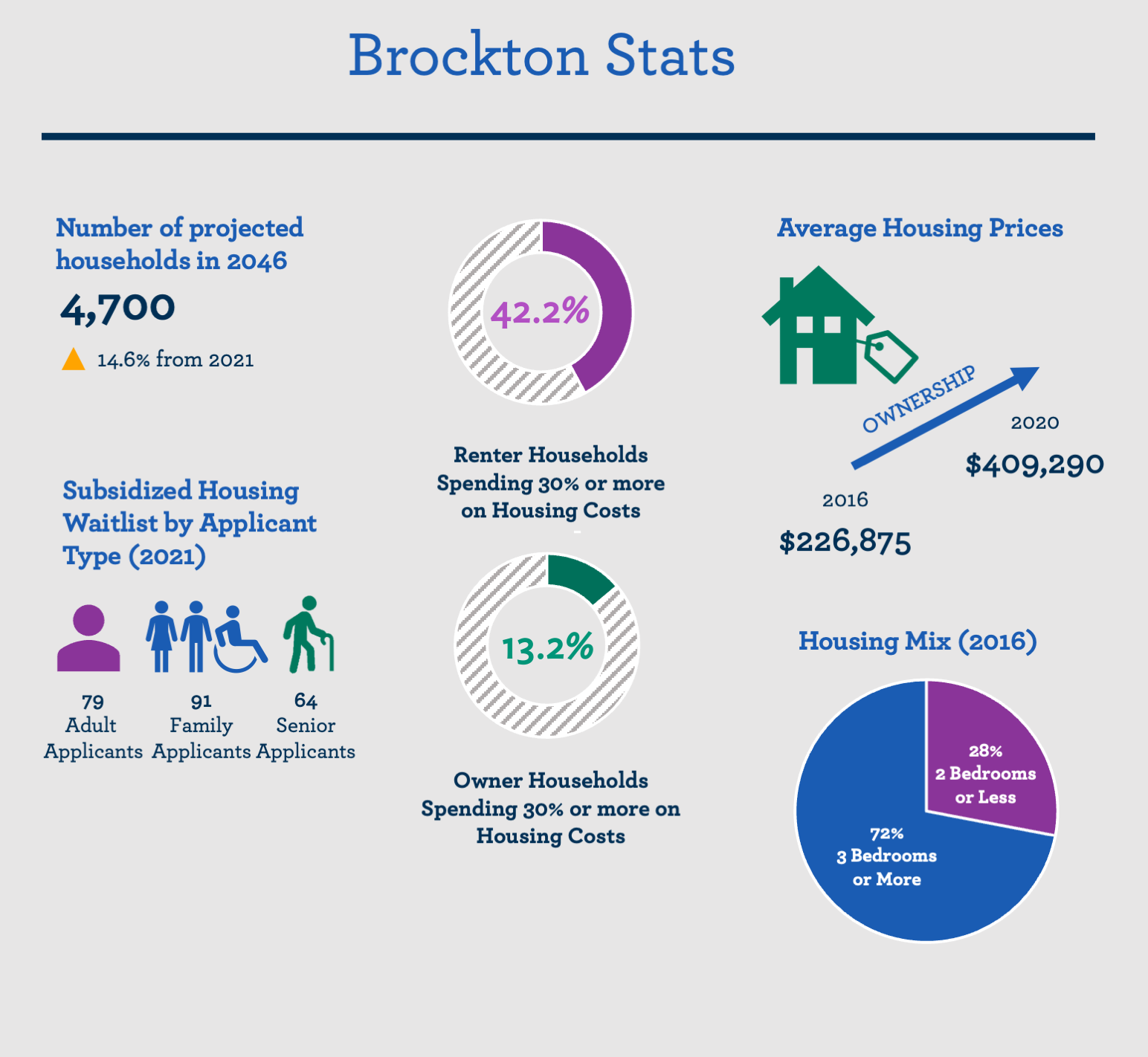

Communities in the Municipality of Brockton include the former town of Walkerton and the villages within the boundaries of the former Brant and Greenock Townships. Brockton is a family-friendly community where leisure time is taken just as seriously as a hard day of work. Community living in Brockton is centered around active lifestyle – residents enjoy participating in organized sports, arts and culture, hiking, fishing, and volunteering. A major attraction in the municipality is the Greenock Swamp Wetland Complex which covers over 20,000 acres of land in the western portion of Brockton.

In 2016, Brockton had a population of 9,461 people. The population is expected to grow to approximately 11,000 by 2046. 62.08% of the population are in the working age group between 15 to 64 years old, with a labour force participation rate of 68.2%. By 2046, there are expected to be roughly 3,100 jobs in the municipality, an increase of 13% from 2021.The median household income in 2016 was $67,597.

Housing Needs and Issues

- An estimated 4,100 households called Brockton home in 2021. This is an increase of approximately 3.9% from the 3,940 households recorded in 2016. The number of households is expected to grow by an additional 12.8% to 4,700 by 2046.

- In Brockton, 77.7% of residents own their homes while 22.3% are renters. Housing affordability is an issue in Brockton, particularly for renter households. As of 2016, over 13.2% of homeowners in Brockton were spending over 30% of their income on their housing, compared to 42.2% of renters.

- This is a trend that will continue as the cost of owning a home in Brockton has grown from $226,875 in 2016 to $409,290 in 2020, representing a 44.6% increase in cost.

- In 2021, there were 234 households on the waitlist for subsidized housing in Brockton. Most of the applicants were families (91), followed by adults (79) and seniors (64). The number of households on the waitlist increased across all applicant types between 2020 and 2021 indicating an increased need for affordable housing for all applicant types.

- In 2016, working age individuals (15 to 64 years old) made up 53.9% of the population, while seniors represented 21% of the population. The number of seniors is presumed to have grown since 2016.

- In 2016, only 28.1% of all homes in Brockton had 2 bedrooms or less. Working age individuals and seniors often require smaller, affordable dwellings.

What you should know about developing here

Bruce County’s Planning and Development Department - Inland Hub is responsible for planning approvals in the Brockton. Building permit approvals are granted through Brockton’s Chief Building Official.

Overview of the Municipal Context

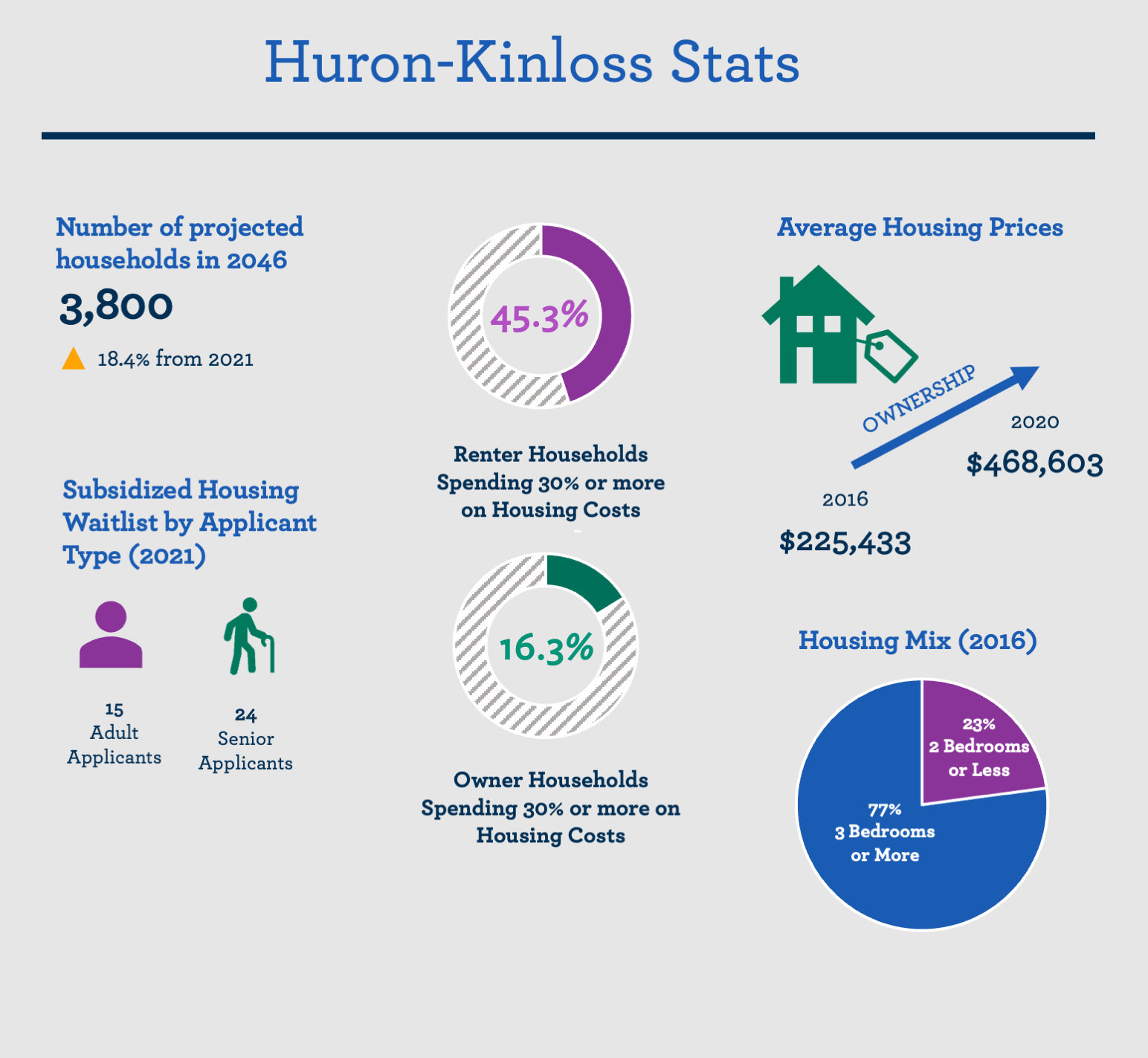

The Township of Huron-Kinloss is comprised of 3 main communities: Lucknow, Ripley, and Point Clark. Located on the shores of Lake Huron, Huron-Kinloss is 1.5 hours from Kitchener-Waterloo, 2 hours from London and 2.5 hours from Toronto. The three main industries in Huron-Kinloss are Agriculture, Tourism, and Energy. Bruce Power is one of the main economic drivers in the area and is only 30-45 minutes from Huron-Kinloss.

Huron-Kinloss had a population of 7,260 people in 2016. The population is expected to grow by 17.5% to 9,700 by 2046. 58.9% of the population are in the working age group between 15 to 64 years old, with a labour force participation rate of 64.6%. By 2046 there will be an estimated 2,800 jobs in the municipality, an increase of 17.9% from 2021. As of 2016, the median household income, before taxes, was $75,456.

Housing Needs and Issues

- An estimated 3,100 households called Huron-Kinloss home in 2021. This is an increase of approximately 10.3% from the 2,780 households recorded 2016. The number of households is expected to grow by a further 18.4% between 2021 and 2046, for a total of 3,800 households.

- As of 2016, 86.2% of households in Huron-Kinloss owned their homes while 13.8% rented their home. Of these households, renters were more likely to experience challenges with affordability as the proportion spending over 30 percent of their income on housing was 45.3% percent. In comparison, 16.3% of owner households had the same issue.

- The growth in ownership costs do indicate that affordability may be a growing issue in Huron-Kinloss. The cost of owning a home in South Bruce has grown by 51.9% from $225,433 in 2016 to $468,603 in 2020.

- In 2021, there were 39 households on the waitlist for subsidized housing in Huron-Kinloss, a decrease from both the 41 households on the waitlist in 2020 and the 55 households recorded in 2019. The greatest share of applicants were seniors (15), followed by adults (24). The number of seniors on the waitlist, and their proportion of the total increased from 19 applicants in 2020.

- In Huron-Kinloss 65.0% of the population are in the working age group between 15 to 64 years old while 22.1% are seniors. This indicates a need for housing that allows working age and those looking to downsize housing that reflect their lifestyles and typically smaller household sizes. In 2016, only 23% of all homes in Huron Kinloss have 2 bedrooms or less while 77% of all dwellings had 3 or more bedrooms and can accommodate larger households.

What you should know about developing here

Bruce County’s Planning and Development Department - Inland Hub is responsible for all planning approvals in the Municipality of Huron-Kinloss. Building Permit Approvals are granted through Huron-Kinloss’ Chief Building Official

Development Tools and Incentives

The Municipality of Huron-Kinloss does not charge development charges for residential secondary units. In addition, the Municipality has taken several steps to support the development of housing, including a broader mix of housing unity types, sizes and prices. These include: the alignment of minimum dwelling unit size requirements with the Ontario Building Code, the inclusion of a broader range of housing dwelling types within residential zones, and expanded permissions for Additional Dwelling Units on properties within fully-serviced areas. Looking forward, Municipal Staff continue to identify opportunities for the appropriate development of housing and make an effort to work closely with property owners and developers to provide support and guidance for all projects in the municipality.

Overview of the Municipal Context

The Municipality of Kincardine is a beautiful lakeside community that is home to many permanent and seasonal residents and welcomes visitors from around the world. It is bordered by prime agricultural land to the south and east and home to world-class energy production and engineering in the north.

In 2016, Kincardine had a population of 11,389. Nearly 62% were aged 15-64, and the labour force participation rate was 61.6%. The population is expected to grow to 14,000 (16.5%) in 2046.

The number of jobs in Kincardine are expected to grow to 15,100 in 2046, which includes those working from home or with no fixed place of work. The municipality has a high level of educational attainment, with 67.1% of residents having achieved post-secondary education or credentials. As of 2016, the median household income, before taxes, was $86,363.

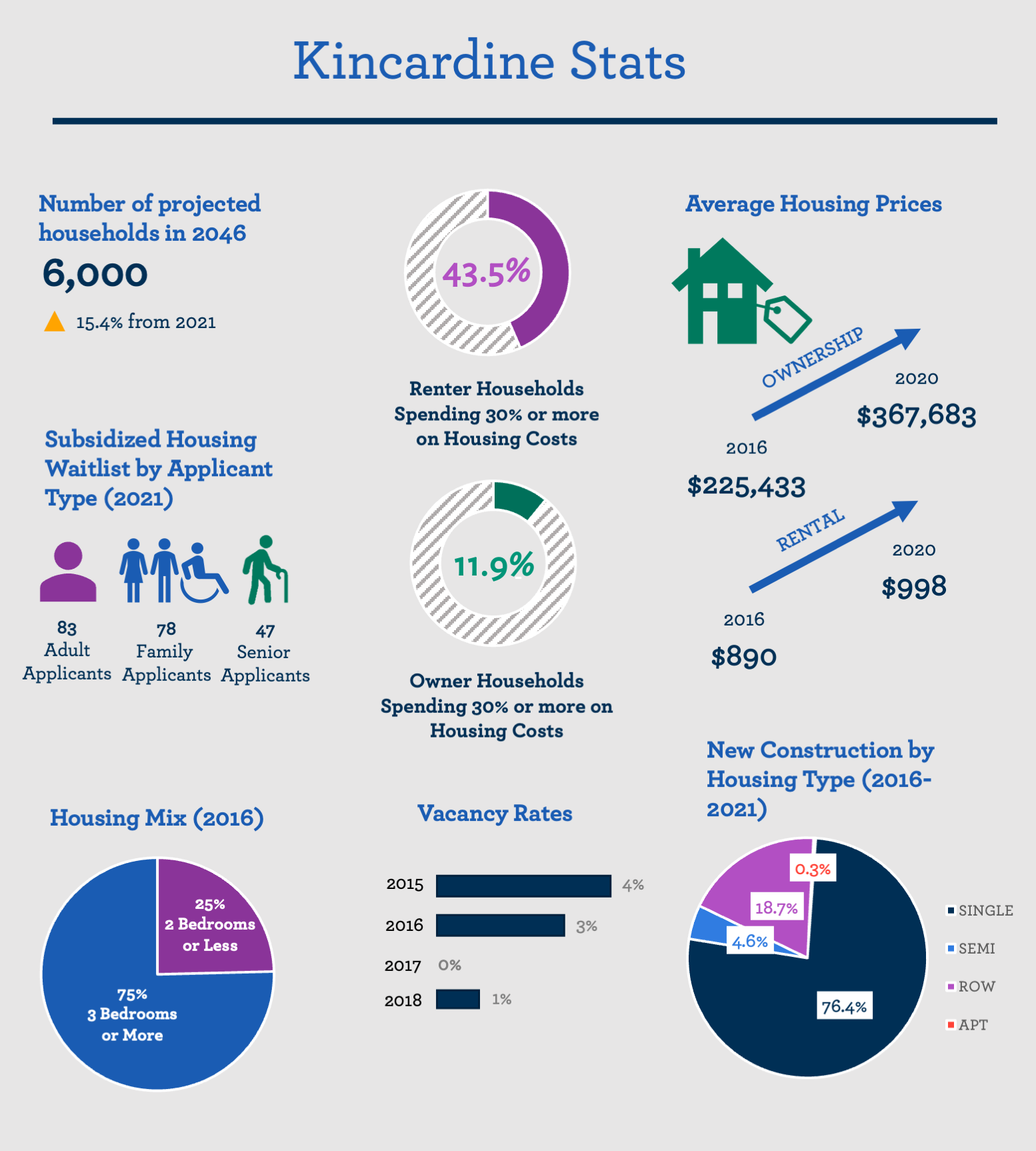

Housing Needs and Issues

- There were a projected 5,200 households in Kincardine in 2021, up by 6.7% from 2016 when there were 4,850 households. By 2046, the number is expected to increase to 6,000.

- As of 2016, about 13% of homeowner households in Kincardine were spending over 30% of their income on their housing. In comparison, 40% of renter households were spending 30% of their income on housing.

- The average cost to buy a home increased from $225,433 in 2016 to $367,683 in 2020, growing by 38.7%. Similarly, the average cost of rental housing has risen by 10.8% from $890 in 2016 to $998 in 2020. Average housing prices in Kincardine for both ownership and rental tenure skew lower, due to a greater supply of smaller medium-to-high density housing units in the municipality.

- In 2021, there were 208 households on the waitlist for subsidized housing in Kincardine. Most of the applicants were adults (83), followed by families (78) and seniors (47). The number of families on the waitlist has grown from 73 households in 2019 to 78 households 2021, making this the only applicant group to have increased in numbers on the waitlist. The rates of adults and seniors on the waitlist has fallen by 48.2% and 34.0% respectively.

- In 2016, only 24.6% of homes in Kincardine had 2 bedrooms or less. From 2016 to 2020, there were 348 new homes constructed in Kincardine. Of these new builds, only one apartment building was constructed, the majority being lower density single family homes (76.4%) and rowhouses (18.7%).

- In 2016, 80.6% of households owned their homes while 19.4% were renters. However, vacancy rates for rental units in Kincardine fell from 4% in 2015 to 1% in 2018. This indicates a growing demand for more rental housing in the municipality. It could also indicate that more households are having difficulty affording to buy a home in the municipality.

- The growth in demand for rental housing also means that there is a need for more smaller dwelling types such as apartments or townhomes.

What you should know about developing here

Kincardine has a local Development Services department, which is responsible for zoning administration and site plan approvals and building permits. Minor variances, zoning changes and plan amendments, as well as lot creation proposals, are processed by Bruce County’s Planning Department.

Development Tools and Incentives

Kincardine has a development charges exemption for new affordable housing construction.

Overview of the Municipal Context

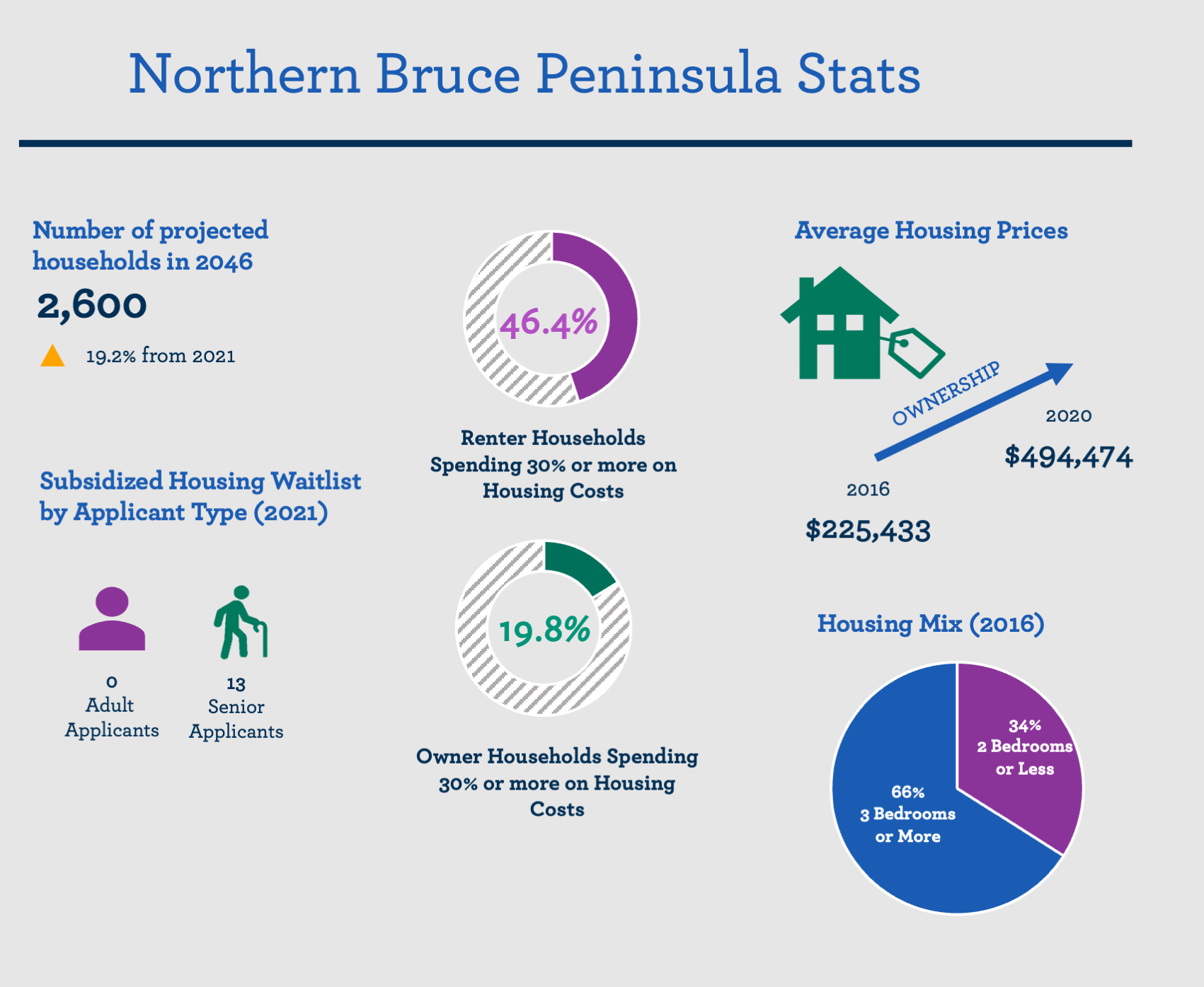

Northern Bruce Peninsula is widely known as a tourist destination and is home to a uniquely talented arts community. The municipality offers recreation and relaxation to suit everyone's needs, with the downtowns of Lion's Head and Tobermory providing one-of-a-kind experiences.

Northern Bruce Peninsula had a population of 3,999 people in 2016. The population is expected to grow by 19.3% to 5,700 by 2046. 52.8% of the population are in the working age group between 15 to 64 years old, with a labour force participation rate of 49.3%. By 2046 there will be an estimated 1,900 jobs in the municipality, an increase of 15.8% from 2021. As of 2016, the median household income, before taxes, was $59,776.

Housing Needs and Issues

- There were approximately 2,100 households in Northern Bruce Peninsula in 2021. This is an increase of approximately 8.1% from the 1,930 households recorded 2016. The number of households is expected to grow by an additional 19.2% between 2021 and 2046, for a total of 2,600 households.

- As of 2016, 92.5% of households in Northern Bruce Peninsula owned their homes, while 7.5% of households were renters. Renter households were more likely to experience housing affordability challenges with 46.4% of renter households were spending 30% more or of their household income, compared to 19.8% of owners.

- The cost to own a home in the municipality has risen from $225,433 in 2016 to $494,474 in 2020, marking a 54.4% increase. These factors indicate that affordable housing is a need in Northern Bruce Peninsula.

- In 2019 through 2021, seniors were the only applicants on the waitlist for subsidized housing in Northern Bruce Peninsula. The number of applicants has varied during this time from 18 applicants in 2019, reaching a peak number of 24 applicants in 2020 and falling to 13 in 2021.

- In 2016, 33.3% of all homes in North Bruce Peninsula had 2 bedrooms or less, which is a higher rate of smaller units than is typically seen throughout Bruce County. 66.6% of all dwellings had 3 or more bedrooms and can accommodate larger households.

- 52.8% of the population are in the working age group between 15 to 64 years old. Seniors aged 65 years and older also make up a significant proportion of the population.

What you should know about developing here

Bruce County Planning and Development Department – Peninsula Hub is responsible for planning approvals in the municipality. Building permit approvals are granted through Northern Bruce Peninsula’s Chief Building Official.

Overview of the Municipal Context

The Town of Saugeen Shores is found along the Lake Huron shoreline, just west of Arran-Elderslie and north of Kincardine. Saugeen Shores includes the communities of Port Elgin and Southampton.

In 2016, Saugeen Shores had a population of 13,715 people. The population is expected to grow 21.2% to 20,800 by 2046. 61.09% of the population is in the working age group between 15 to 64 years old, with a labour force participation rate of 60.1%. Today, there are roughly 5,600 jobs in the municipality and an additional 1,300 jobs are expected to be added by 2046. As of 2016, the median household income, before taxes, was $87,916.

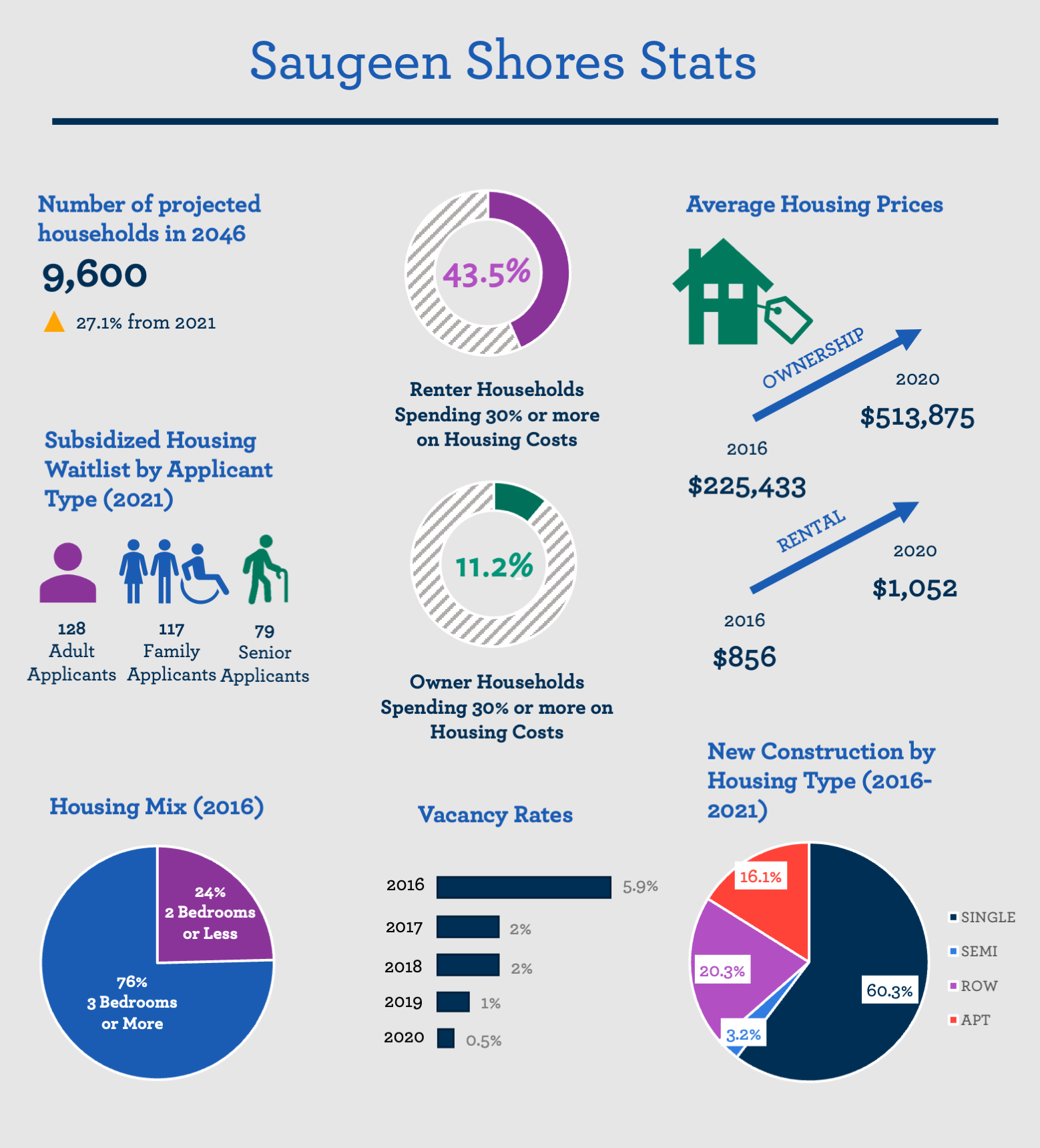

Housing Needs and Issues

- An estimated 7,000 households called Saugeen Shores home in 2021. The number of households is expected to further grow by 27.1% to 9,600 households by 2046.

- In 2016, 79.4% of households in Saugeen Shores owned their homes, while 20.6% were renters. Between 2016 and 2019, the vacancy rate for rental units in Saugeen Shores fell from 5.9% to 0.5%. This indicates an overall need for more rental housing stock to be added to the market to meet the growing demand.

- Housing affordability is an issue for households in the town, primarily impacting renter households of whom 43.5% are spending 30% or more of their income on housing. In comparison, 11.2% of owners face the same issues with affordability.

- The price to buy a home increased from $225,433 in 2016 to $513,875 in 2020, growing by 56.1%. Similarly, the average cost of rental housing has risen by 18.6% from $855 to in 2016 to $1,052 in 2020. Average housing prices in Saugeen Shores for both ownership and rental tenure skew lower, due to a greater supply of smaller medium-to-high density housing units in the municipality.

- In 2021, there were 324 households on the waitlist for subsidized housing in Saugeen Shores. The greatest share of applicants were adults (128), followed by families (117) and seniors (79). While the number of households on the waitlist decreased for all applicant types by from 259 applicants in 2019, the number of seniors on the waitlist increased the most, growing from 62 applicants in 2019 to 79 in 2021 indicating greater housing need for this population over time.

- From 2016 to 2020, 812 medium-to-high density homes, such as apartment buildings (16.1%) and rowhouses (20.3%), were constructed in Saugeen Shores. Given the growth in the demand for rental housing and the population of working age and senior households, the Town looks to increase the proportion of medium-to-high density housing to accommodate the needs of current and future residents.

What you should know about developing here

Bruce County Planning and Development Department- Lakeshore Hub is responsible for planning approvals in the municipality. Building permit approvals are granted through Saugeen Shores Chief Building Official.

Development Tools and Incentives

Saugeen Shores has several incentives relating to the development of new affordable and rental housing, including:

- Allowing new rental developments to pay development charges over a five-year period

- Exempting qualifying rental housing designed to be universally accessible, containing three-bedroom apartments, or located near the downtown from paying development charges

- Exempting federally funded or subsidized affordable housing from development charges

- Exempting basement apartments and other similar units from development charges

- Updates to the Official Plan and Zoning By-Law which increase flexibility for property owners as it pertains to creating new additional residential units in both the urban and agricultural areas of the municipality

- A Community Improvement Plan (CIP) which provides a range of incentives for property owners, such as: property tax assistance, municipal fees rebates, parking relief, parkland reduction and expedited approval

- The Town may also consider the disposition of reserve funds and surplus municipal land to facilitate construction of affordable housing units

Overview of the Municipal Context

The Municipality of South Bruce is known as a gateway to Bruce County. It’s an area of rolling hills, scenic highways, and warm-hearted people. South Bruce is comprised of the Village of Mildmay and the surrounding Township of Carrick, the Village of Teeswater and the surrounding Township of Culross, and the Village of Formosa.

In 2016, South Bruce had a population of 5,639 people. The population is expected to grow to 6,700 by 2046. 65.07% of the population are in the working age group between 15 to 64 years old, with a labour force participation rate of 73.3%. There are roughly 2,000 jobs in the municipality and an additional 300 jobs are expected to be added by 2046. As of 2016, the median household income, before taxes, was $71,270.

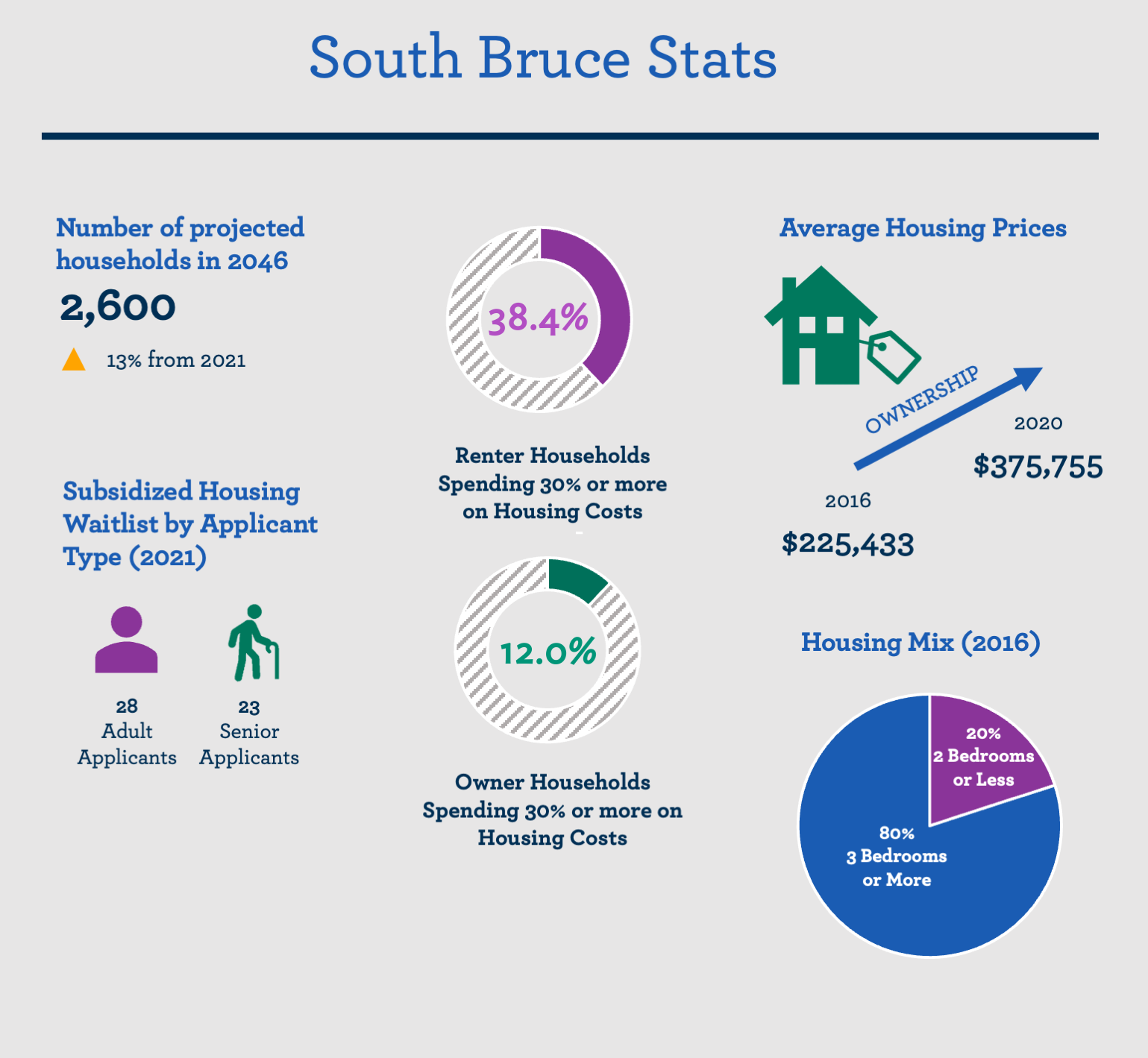

Housing Needs and Issues

- An estimated 2,300 households called South Bruce home in 2021. This is an increase of 3.9% from 2016. The number of households is expected to further grow by 11.5% to 2,600 households in 2046

- As of 2016, 83.2% of residents owned their home, while 16.8% rented their home.

- In 2016, over 12% of homeowner households in South Bruce were spending over 30% of their income on their housing. For renter households, the proportion spending over 30% of their income on housing was 38.4%. The growth in ownership costs indicate that unaffordability may be a growing trend in South Bruce, as the average home price jumped from $225,433 in 2016 to $375,755 in 2020.

- In 2021, there were 51 households on the waitlist for subsidized housing in South Bruce, 28 applicants were adults and 23 were seniors. From 2019 to 2021, there has been a 17.4% increase in the number of seniors on the waitlist while the number of adults has fallen by 103.6%. This indicates that seniors are more likely to be in housing need.

- In South Bruce, 65.07% of the population are in the working age group between 15 to 64 years old, while 16.9% are seniors. In 2016, only 20.1% of all homes in South Bruce have 2 bedrooms or less. Working age individuals and seniors often require smaller, affordable dwellings.

What you should know about developing here

Bruce County’s Planning and Development Department - Inland Hub is responsible for all planning approvals in the Municipality of South Bruce. Building permit approvals are granted through South Bruce’s Chief Building Official.

Development Tools and Incentives

The Municipality of South Bruce does not levy development charges on new development.

Overview of the Municipal Context

South Bruce Peninsula is comprised of several hamlets and villages, along with the two larger urban areas: Sauble Beach and Wiarton.

People visit the area for its natural beauty – the extensive trail systems, the pristine waters of Georgian Bay, and the sandy shoreline along Lake Huron – and they stay for the quality of life.

In 2016, South Bruce Peninsula had a population of 8,416 people. The population is expected to grow to 10,100 by 2046. 57.3% of the population is in the working age group between 15 to 64 years old, with a labour force participation rate of 56.7%. There are 3,100 jobs in the municipality and an additional 600 jobs are expected to be added by 2046. As of 2016, the median household income, before taxes, was $57,766.

Housing Needs and Issues

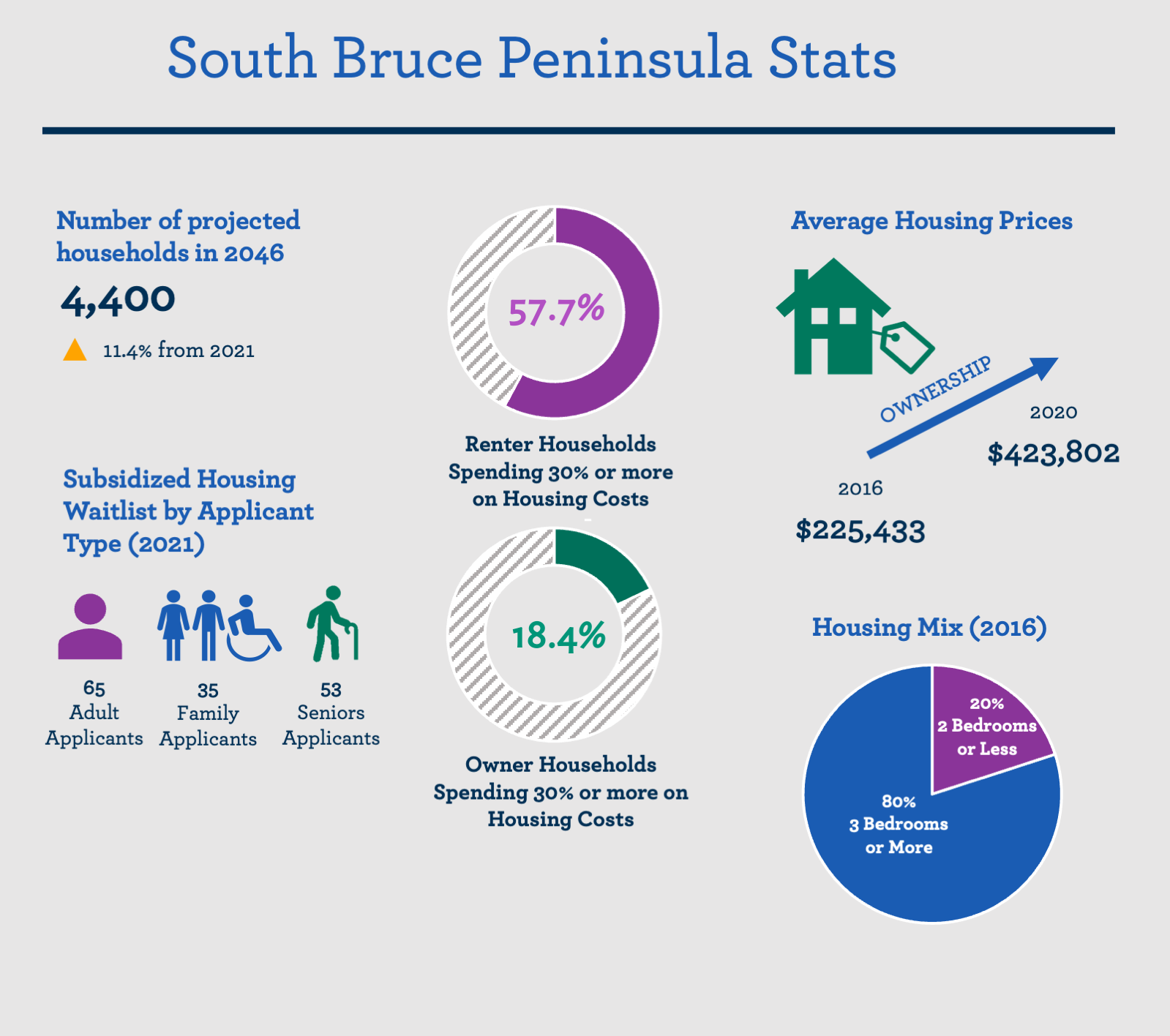

- There were approximately 3,900 households in South Bruce Peninsula in 2021 and an estimated 500 households will be added by 2046.

- As of 2016, 82.1% of residents owned their homes while 17.9% were renters.

- As of 2016, over 18.4% of households in South Bruce Peninsula who own their own home were spending over 30% of their income on their housing. For renter households, 57.7% were spending over 30% of their income on housing.

- Affordability issues are a growing concern as the cost of owning a home in South Bruce Peninsula has grown from $225,433 in 2016 to $423,802 in 2020, representing a 46.8% increase in cost.

- In 2021, there were 153 households on the waitlist for subsidized housing in South Bruce Peninsula. Most of the applicants were adults (65 applicants), followed by seniors (53) and then families (35). The number of seniors on the waitlist has increased from 38 households in 2019 to 53 households 2021. The rates of adults has fallen by 46.2% while the number of families has grown by 2.9%. This indicates that seniors and families were more likely to experience difficulty finding housing that accommodated their household needs compared to adults.

- Seniors make up a significant proportion of the population, representing 30.5% of the population, while 57.31% of the population are in the working age group between 15 to 64 years old. In 2016, only 20.1% of all homes in South Bruce Peninsula has 2 bedrooms or less. This indicates a need for more affordable, smaller sized housing options suited to working age individuals and older adults looking to downsize.

What you should know about developing here

As South Bruce Peninsula is a small community, Bruce County’s Planning and Development Department - Peninsula Hub is responsible for process the majority of planning applications in the municipality. Building Permit Approvals are granted through South Bruce Peninsula’s Chief Building Official.

The municipality recently removed the required minimum square footage provisions for residential units from its zoning bylaw, making it easier for developers to build smaller and affordable units.

Development Tools and Incentives

South Bruce Peninsula collects Development Charges for the areas in and immediately around the community of Wiarton.

CMHC National Co-Investment Fund (New Construction)

Program DescriptionThe National Housing Co-Investment Fund (NHCF) is a program administered by CMHC that is part of the National Housing Strategy. The fund provides low-cost loans and/or financial contributions to support and develop mixed-income, mixed-tenure, mixed-use affordable housing. This housing must be energy efficient, accessible, and socially inclusive. The National Housing Co-investment Fund prioritizes projects that support partnerships between governments, non-profits, private sector, and others to make federal investment go further. It covers a broad range of housing needs, from shelters to affordable homeownership. The goal of the initiative is to create 60,000 new units over ten years. This funding is for new construction only and cannot be used for acquisition of existing units.

The maximum eligible low-interest loan and/or contribution amount is determined through CMHC’s housing priority scoring grid. Factors used to prioritize and select applications for further assessment include:

- Affordability

- Energy efficiency

- Accessibility

- Proximity to transit

- Amenities and community support

- Collaboration/partnerships

- Social inclusion and supporting federal priority groups (including seniors)

Website: For more information, please visit the website here.

Contact: Please call Contact Centre at 1-800-668-2642 or send email to ahc_on@cmhc-schl.gc.ca to connect with a specialist according to your region and type of project.

CMHC Rapid Housing Initiative

Program Description and availability in Bruce CountyThe Rapid Housing Initiative (RHI) addresses the urgent housing needs of our most vulnerable populations. These groups include:

- Women and children fleeing domestic violence

- Seniors

- Young adults

- Indigenous peoples

- People with disabilities

- People dealing with mental health and addiction issues

- Veterans

- LGBTQ2+

- Racialized groups

- Recent immigrants, especially refugees

- People experiencing homelessness

Under the Cities Stream, pre-determined municipalities have been notified of their allocations. Under the Projects Stream, only the applicants who applied during the first round of RHI and had eligible projects that remained unfunded will be considered. It is unknown at this time whether there will be a third round of RHI funding.

Website: For more information, please visit the website here.

Contact: Please call Contact Centre at 1-800-668-2642 or send email to ahc_on@cmhc-schl.gc.ca to connect with a specialist according to your region and type of project.

CMHC Seed Funding

Program Description and availability in Bruce CountyIf a project can show its financially feasible, it will be considered for CMHC Seed Funding. The Seed Funding program provides grants and interest-free loans to affordable housing projects to prepare them to access RCFI and Co-Investment Fund funding. This funding can help cover some of the predevelopment costs associated with affordable housing projects. These costs can include:

- Incorporation

- Preliminary financial feasibility

- Municipal fees and charges

- The development of a business plan and project drawings/specifications

- Site studies and surveys

Seed Funding is available in the form of a non-repayable contribution of up to $150,000. Additional funds may be made available in the form of a fully repayable, interest-free loan of up to $350,000. For a project to be eligible, the project must demonstrate some form of site control (either the site is already owned by the proponent or the proponent has entered into a Purchase and Sale Agreement to acquire the site). This funding cannot be used for land acquisition.

GST and PST Rebates Non-profit organizations could be eligible to apply for a full rebate on both the GST and PST portions of the HST paid on the taxable capital costs for any project that the organization might develop.

Website: For more information, please visit the website here.

Contact: Please call Contact Centre at 1-800-668-2642 or send email to ahc_on@cmhc-schl.gc.ca to connect with a specialist according to your region and type of project.

Federal Lands Initiative

Program Description and availability in Bruce CountyThe Federal Lands Initiative is a $200-million fund that supports the transfer of surplus federal lands and buildings to eligible proponents. This is available at discounted to no cost to be developed or renovated for use as affordable housing. The discount on the property will depend on the level of social outcomes achieved by the winning proposal. Once transferred, the property will be developed or renovated into affordable, sustainable, accessible and socially inclusive housing. This initiative is open to community and co-operative housing organizations, non-profits, Indigenous governments/organizations, for-profit organizations, and municipal and regional governments.

Eligible affordable housing projects include, but are not limited to:

- mixed-income

- mixed-use (commercial space should not exceed 30% of gross floor area)

- mixed-tenure

- shelters

- Transitional housing

- supportive housing

- rental housing

- affordable homeownership

When surplus federal lands and buildings are identified as available for development into affordable housing units and communities, a list of properties is made publicly available on the program’s website.

Website: For more information, please visit the website here.

Contact: Please call Contact Centre at 1-800-668-2642 or send email to ahc_on@cmhc-schl.gc.ca to connect to a specialist according to your region and type of project.

Provincial Surplus Lands

Program Description and availability in Bruce CountyAny property within the Infrastructure Ontario managed portfolio that is no longer required for the delivery of government programs and services, is classified as surplus and a land assessment and due diligence process is initiated. Municipalities with surplus lands are then able to sell or lease lands to private and not-for-profit developers to develop affordable housing. Should surplus land in Bruce County be put on the market, the County and the relevant lower-tier municipality will issue a Public Notice declaring lands for sale.

A listing of properties for sale is available here.

Website: For more information, please visit the website here.

Contact: To learn about surplus provincial lands as they are identified, you can sign up for Infrastructure Ontario’s electronic communications here.

Shared Equity Mortgage Providers Fund

Program Description and availability in Bruce CountyThe Shared Equity Mortgage Providers Fund is a 5-year program that launched on July 31, 2019. This $100-million lending fund has two funding streams: Pre-Construction Loans (Stream 1) and Shared Equity Mortgages (Stream 2). It aims to assist in the completion of 1,500 new units and help at least 1,500 homebuyers buy their first home.

The Pre-Construction Loans – Stream One provides funding for preconstruction cost loans to commence new housing projects in which shared equity mortgages will be provided to homebuyers via Shared Equity Mortgage Providers. A commitment to reserving a certain percentage of units for first-time homebuyers as defined by the Government of Canada’s Home Buyers’ Plan will be considered a strength on the application.

Eligible Pre-Construction Activities include:

- Incorporation

- Preliminary financial feasibility

- Municipal fees and charges

- The development of a business plan and project drawings/specifications

- Site studies and surveys

Applicants must agree that shared equity mortgages related to the project will be provided to recipients who can satisfy a minimum 5% down payment from their own resources.

Shared Equity Mortgages – Stream 2 supports existing shared equity mortgage providers by providing loans to fund shared equity mortgages provided to first time homebuyers.

Applicants must agree that the shared equity mortgages offered will be made available to homebuyers who meet the following criteria:

- Provide a minimum 5% down payment from their own resources

- Meet the definition of a first-time homebuyer under the Government of Canada Home Buyers’ Plan, which includes the dissolution of a marital or common law relationship (at least one of the homebuyers)

- •CMHC’s preference is for the first mortgages to be with a lender approved by CMHC under the National Housing Act for mortgage loan insurance. CMHC may consider exceptions on a case-by-case basis taking into consideration the proposal, business model and loan security.

Website: For more information, please visit the website here.

Contact: Phone: 1-800-668-2642

Email: contactcentre@cmhc.ca

Community Housing Renewal Strategy

Program Description and availability in Bruce CountyThe Community Housing Renewal Strategy includes Canada-Ontario Community Housing Initiative and The Ontario Priorities Housing Initiative (OPHI). Funding for each initiative is allocated on a yearly basis to the local Service Manager for Housing, who distributes the funding. Accessing these funds would require interested applications to coordinate with Service Managers in Bruce County.

The Canada-Ontario Community Housing Initiative provides funding to Service Managers to replace the federal Social Housing Agreement funding that expires each year, beginning April 2019. This funding can be used by Service Managers to repair, regenerate, and expand community housing and to protect affordability support for tenants.

Ontario Priorities Housing Initiative includes capital funding for expenditures on affordable rental construction (up to $50,000 per unit), affordable Rental acquisition or rehabilitation, affordable rental conversion, the development of social housing, affordable homeownership, and down payment assistance. In addition, OPHI includes an operating expenditures component including funding for rent supplements, portable housing allowances and support services.

Website: For more information, please visit our website here.

Contact: Tania Dickson, Housing Services Manager

Department: Human Services, Human Services

Tel : 1-877-396-3450

Email: TDickson@brucecounty.on.ca

Federation of Canadian Municipalities – Sustainable Affordable Housing

Program Description and availability in Bruce CountyFederation of Canadian Municipalities’ Sustainable Affordable Housing Initiative offers support to local affordable housing providers – including municipal, not-for-profit organizations and housing co-ops – to retrofit existing affordable housing units, or construct energy efficient new builds that emit lower GHG emissions.

The Green Municipal Fund offers support throughout the life cycle of an affordable housing construction project through five funding options:

- Planning: Early support to assist eligible housing providers to get started on achieving more sustainable affordable housing initiatives. Grants of up to $25,000 to cover up to 80% of eligible costs are provided.

- Studies: Assess the approaches needed to implement an eligible energy efficient pilot or capital project in detail. Grants of up to $175,000 to cover up to 50% of eligible costs are provided.

- Pilot projects: Test out a new or innovative approach on a small scale. Grants of up to $500,000 to cover up to 80% of eligible costs are provided.

- Retrofit capital projects: Complete the renovation of existing housing units with the installation of energy efficient technologies. Financing (a combination of a grant and loan) for up to 80% of total eligible project costs up to a maximum of $10 million can be provided.

- New-build capital projects: Construct new homes that are highly energy efficient. Financing (a combination of a grant and a loan) for up to 20% of total eligible project costs up to a maximum combined financing of $10 million can be provided.

Website: For more information, please visit the website here.

Affordable housing - Affordable housing is a housing unit that is owned or rented by a household with shelter costs (rent or mortgage, utilities, etc.) that are no more than 30% of its gross income.

Affordable housing thresholds - The affordable housing threshold is the maximum house price or rent for a unit to be considered affordable. In Ontario, the affordable housing threshold is based on the Provincial Policy Statement's definition of affordable housing.

Affordable rental - Based on the Ontario PPS, affordable ownership housing is the least expensive of:

- Housing for which the purchase price results in annual accommodation costs which do not exceed 30% of gross annual household income for low and moderate incomes households; or

- Housing for which the purchase price is at least 10% below the average purchase price of a resale unit in the regional market area.

Additional residential unit (ARU) - An additional residential unit is a self-contained unit with a private kitchen, bathroom facilities, and sleeping areas in a main residential building (such as a single detached house, semi-detached house, or townhouse) and/or a separate building (such as above a detached garage) on the same property. These are also called secondary suites, granny flats, in-law suites, laneway suites, carriage houses, and coach houses.

Complete community - Complete communities are places where homes, jobs, schools, community services, parks and recreation facilities are easily accessible, supporting support quality of life and human health. Whether they are urban, suburban, or rural, complete communities:

- are compact,

- foster vibrant public interaction and give residents and workers a sense of place,

- encourage active transportation,

- make efficient use of infrastructure,

- support transit

- provide a mix of housing types and offer a range of affordability,

- offer a range of employment opportunities,

- offer access to healthy local food, and

- are designed to reduce greenhouse gas emissions and address climate change.

Co-operative housing - Households in a co-operative housing project are all members of the co-operative corporation that owns the building. They elect from amongst themselves a board of directors, which is responsible for overseeing the management of the building. They are subject to rules in the Co-operative Corporations Act and are not considered to be landlords and are therefore not subject to the Residential Tenancies Act.

Dwelling unit - A dwelling unit is a structurally separate set of self-contained living premises with a private entrance from outside the building or from a common hall, lobby, or stairway inside the building. Such an entrance must be one that can be used without passing through another separate dwelling unit.

Development charge - Development charges are fees collected from developers to help pay for the cost of infrastructure required to provide municipal services to new development, such as roads, transit, water and sewer infrastructure, community centres, and fire and police facilities.

High-income household - A household is said to have high income if their gross annual income falls within the 70th to 100th income percentile.

Housing affordability - Housing affordability refers to the ability of a household to enter or compete in the housing market.

Housing stock - Housing stock is comprised of all residential properties in a geographic region, excluding vacant land.

Market rental - Market rental units are units in the private rental sector, including the secondary rental market or units in a community housing project where the tenant pays the full rent and does not receive a subsidy.

Missing middle - The missing middle refers to a range of housing types between single-detached houses and apartment buildings that have gone “missing” from many cities in the last 60 to 70 years.

Mixed-use - Development projects may be classified as "mixed-use" if they provide more than one use or purpose within a shared building or development area. Mixed-use projects may include any combination of housing, office, retail, medical, recreational, commercial, or industrial components.

Moderate-income household - A household is said to have moderate income if their gross annual household income falls within the 40th to 60th income percentile.

Multi-residential building - The multi-residential property class, as defined in O. Reg. 282/98, includes:

- property used for residential purposes that has more than six self-contained units, and

- vacant land principally zoned for multi-residential development.

Non-profit housing - Non-profit housing that is affordable to households (generally households with low incomes), which is owned and/or managed by a non-profit organization.

Low-income household - A household is said to have low income if their gross annual household income falls within the 10th to 30th income percentile.

Single detached dwelling - A single detached dwelling is not attached to any other dwelling or structure (except its own garage or shed). A single-detached house has open space on all sides and has no dwellings either above it or below it. A mobile home fixed permanently to a foundation is also classified as a single-detached house.

Tiny home - A tiny home is small, private, and self-contained dwelling unit with living and dining areas, kitchen and bathroom facilities, a sleeping area, and is intended for year-round use. A tiny home can be a primary home or a separate structure on a property that already has an existing house. Campers, recreational vehicles, cottages, and other structures used on a seasonal basis are not considered tiny homes.

Logo

Logo